🌸Sakura & Capital Formation

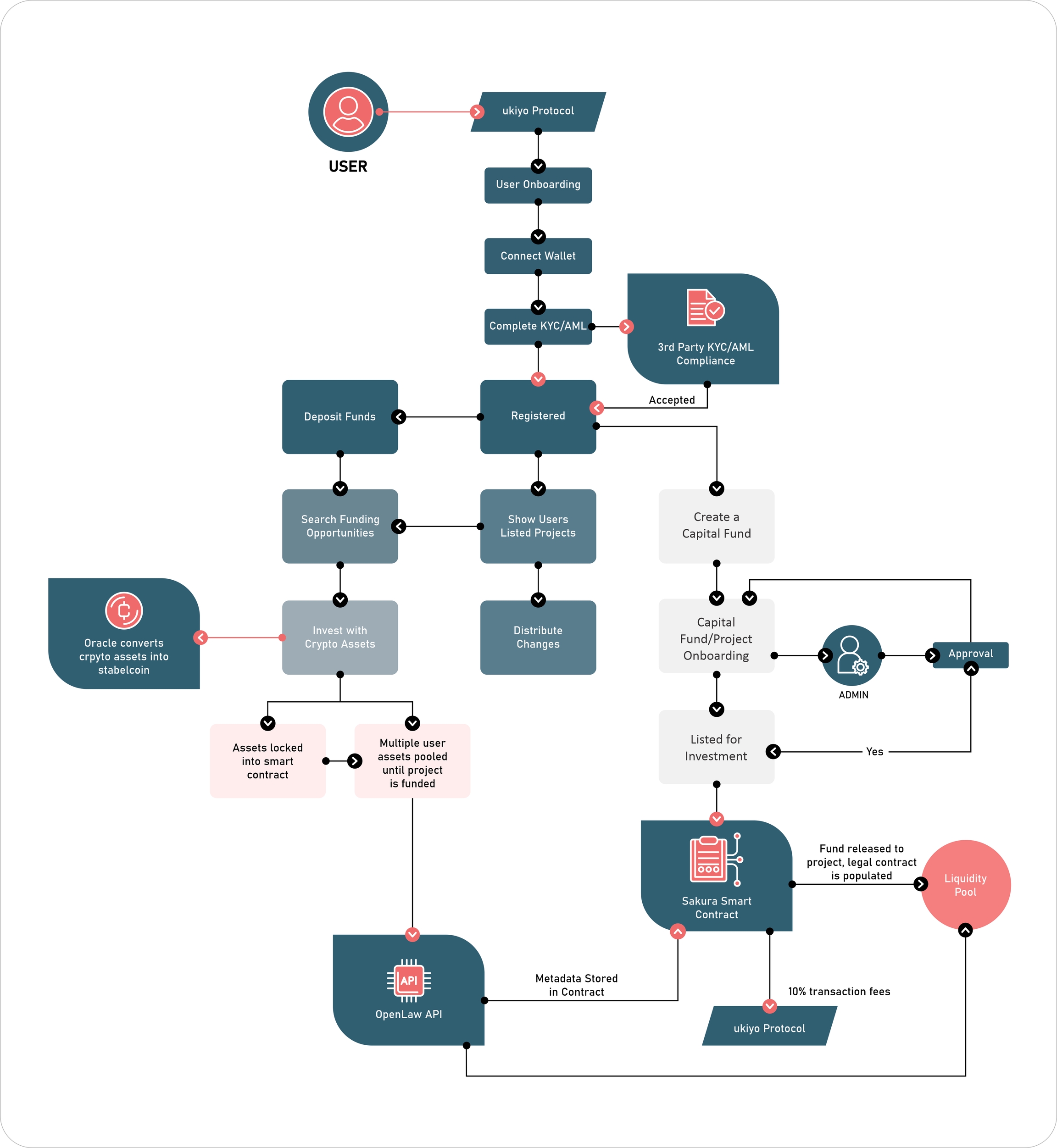

Ventures is powered by the "Sakura" smart contract, alongside a suite of additional engines, including the OpenLaw Protocol and internal data capture tools.

At the core of Ventures is Sakura, a groundbreaking platform that allows potential investors to connect with global projects. Unlike traditional venture capital models, Sakura empowers anyone, anywhere, to invest in ventures and projects. Investors can easily access and explore multiple projects. Upon reaching funding milestones, they can track their investments, receive progress reports, and, if profitable, get dividends directly into their wallets.

Development and Progress

Developing Sakura has been a significant but exciting challenge for the ukiyo team. Currently, the technical framework is in beta testing, and the legal framework and structures are being finalized. The ukiyo community will be kept informed of progress from testing to launch. The team and developers are confident that Sakura will bring a paradigm shift not only in the DeFi and Web3 industries but also in the global financial industry by leveraging blockchain technology for fast, efficient, and borderless capital transfers.

Multi-Token Compatibility with Sakura

Sakura stands out with its ability to accept a variety of whitelisted tokens in its Ventures platform. This flexibility allows projects to:

Receive user contributions in digital assets such as ETH and USDT.

Manage future investments in other forms, including utility tokens and tokenized securities for both on-chain and off-chain companies and projects.

Redemption Process with Sakura

Sakura includes a redemption feature for users wanting to exit a project and sell their stake. This can be done through a sale to other members of the Ventures community or a Ventures leveraged buyout. This process ensures a secure and seamless way for users to divest from their investments.

OpenLaw API

Ventures leverages the OpenLaw Protocol, which wraps smart contracts into a comprehensive legal agreement digitally signed by multiple counterparties. The protocol implements a customized process to convert these OpenLaw contracts into the primary compliance and security functions within Ventures.

Administration of Ventures

Managing user investments in Ventures may involve real-world transactions such as audits, compliance checks, licensing procedures, deal-making, and converting sales proceeds into digital assets. To handle these tasks, Ventures employs a multisignature-controlled administrator role to perform authorized transactions and manage off-chain operational tasks. Initially, this role will focus on establishing funding pools through KYC/AML processes and an orderly auction for shares, equity, or other interests sold to accredited investors using Ethereum-based smart contracts. While there will be a centralized element initially to mitigate regulatory risks, Ventures aims to decentralize its operations and risk parameters over time, moving towards a more open and decentralized system.

Security

To ensure robust smart contracts, Ventures utilizes Chainlink CCIP, powered by Chainlink’s industry-standard oracle networks. The Cross-Chain Interoperability Protocol (CCIP) includes additional protection layers through the Risk Management Network and transfer rate limits.

Token Transfers

Ventures enables seamless scaling of the user base and enhanced token composability by securely transferring tokens across chains quickly, avoiding the need for a custom solution.

Transaction Execution

A transaction price is quoted on the source chain using a gas-locked fee payment mechanism, ensuring execution regardless of destination chain gas spikes and network congestion.

Future-proof

CCIP evolves to support new blockchains, enhanced functionalities, and additional defense-in-depth approaches, ensuring long-term adaptability and security.

Last updated